|

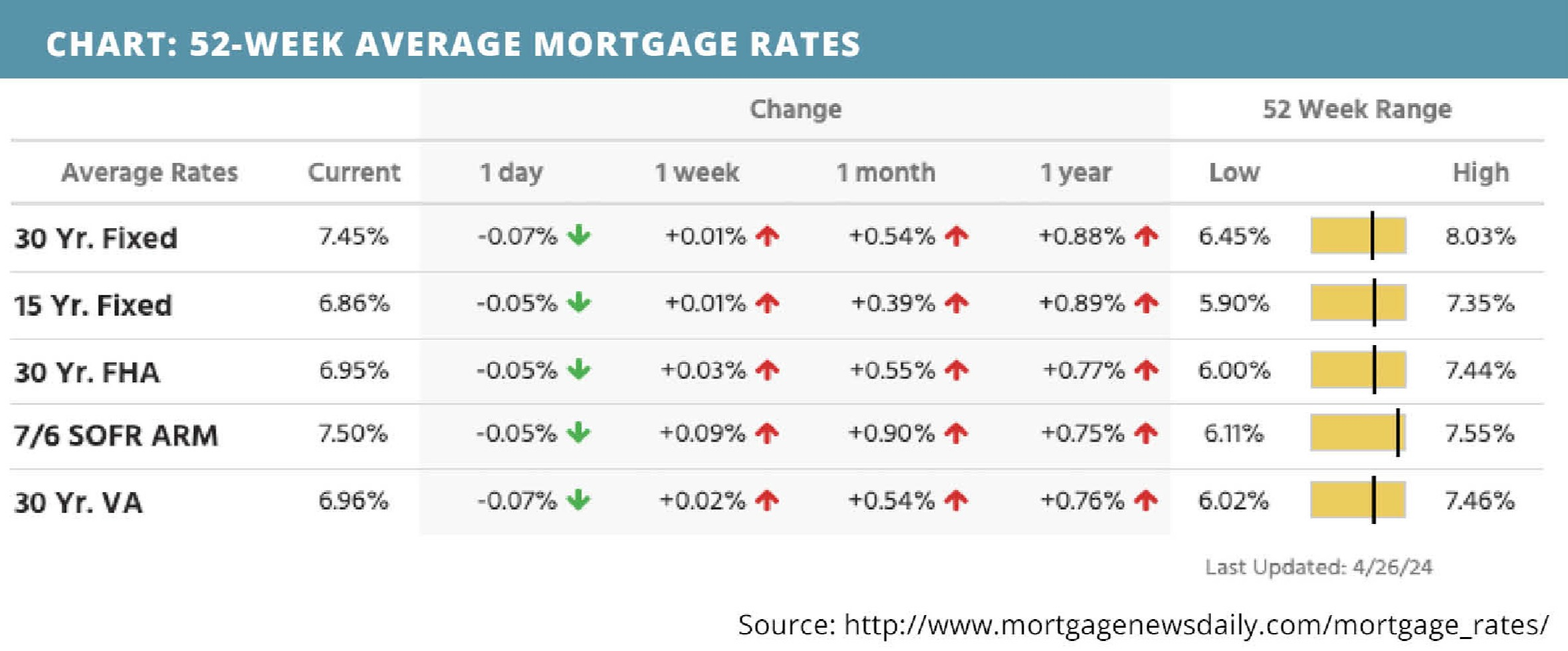

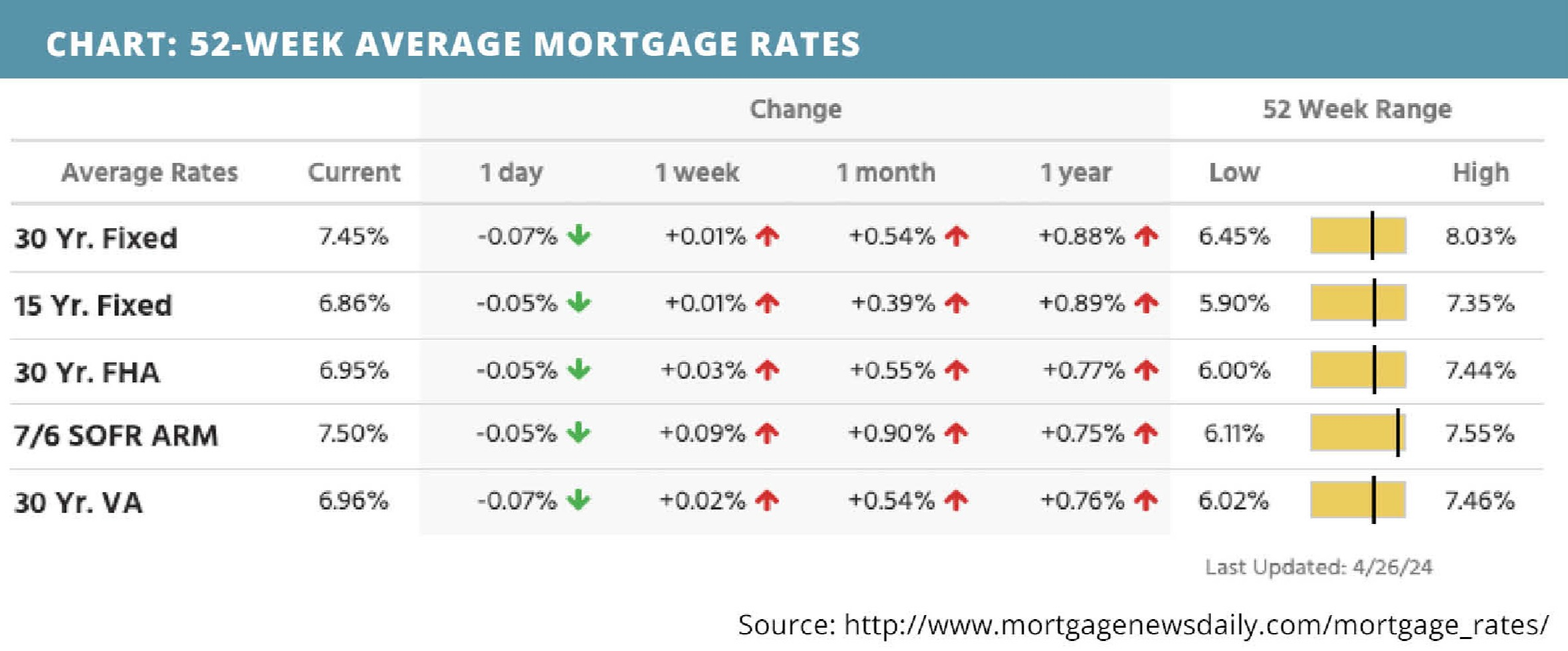

Mortgage rates saw a sharp downward trend following Friday’s employment situation news. Construction spending increased in December. Mortgage application submissions unsurprisingly decreased over the holidays. Job openings decreased in November, but ADP nonfarm employment increased in December. Continuing jobless claims and initial jobless claims slipped. The employment situation showed positive job gains but lower wages and shorter workweeks.

|

|

|

|

|

MORTGAGE RATES CURRENTLY TRENDING

|

|

|

|

THIS WEEK'S POTENTIAL VOLATILITY

|

|

|

|

|

|

- Lead Analyst for HousingWire talks 2023 forecast for the housing market. Listen Now >>

- How homeowners can make the most of their yard this winter. Read Now >>

- Five reasons this isn’t the 2008 housing market. Read Now >>

|

|

|

|

|

-

Construction spending rose 0.2% month-over-month in November, a shocking gain contrary to the predicted fall of 0.4%.

-

Mortgage application submissions fell a composite 10.3% during the two weeks ending 12/30. The holiday adjusted Refinance Index fell 16.3% from two weeks ago while the seasonally adjusted Purchase Index decreased 12.2% from two weeks earlier.

-

Job openings on the Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) for November decreased from 10.51 million to 10.46 million.

-

The ADP nonfarm employment change was expected to fall to 150,000 but ended up climbing to a level of 235,000 in December.

- During the week ending 12/24, continuing jobless claims slipped to 1.69 million a lower fall than what was expected. Initial jobless claims fell to a level of 204,000 during the week ending 12/31 – they were expected to climb to 225,000.

- The employment situation was overall better than expected in December, but a few key reports stood out to the bond market. Average hourly earnings slid from 0.4% to 0.3% month-over-month. Annual average hourly earnings fell from 4.8% to 4.6%; they were expected to climb to 5%. The average workweek was shortened as well – falling to 34.3 hours. Government payrolls saw a noticeable decline to 3,000 from 54,000. Manufacturing payrolls were expected to increase but they remained unchanged at 8,000. Nonfarm payrolls on the other hand, were higher than expected at 223,000, as were private nonfarm payrolls at 220,000. The participation rate increased to 62.3% and the unemployment rate fell to 3.5%.

|

|

|

|

|

|

|

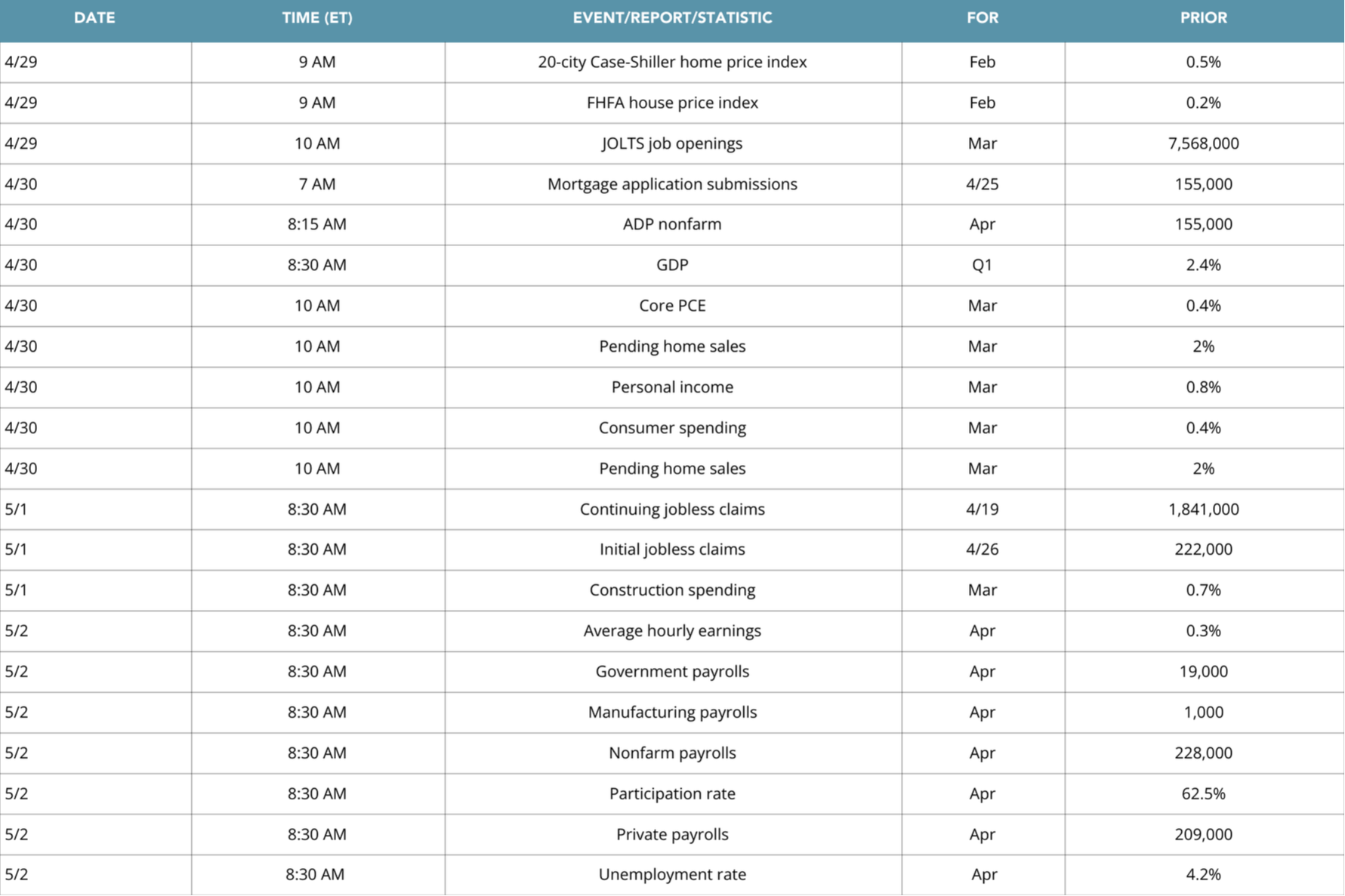

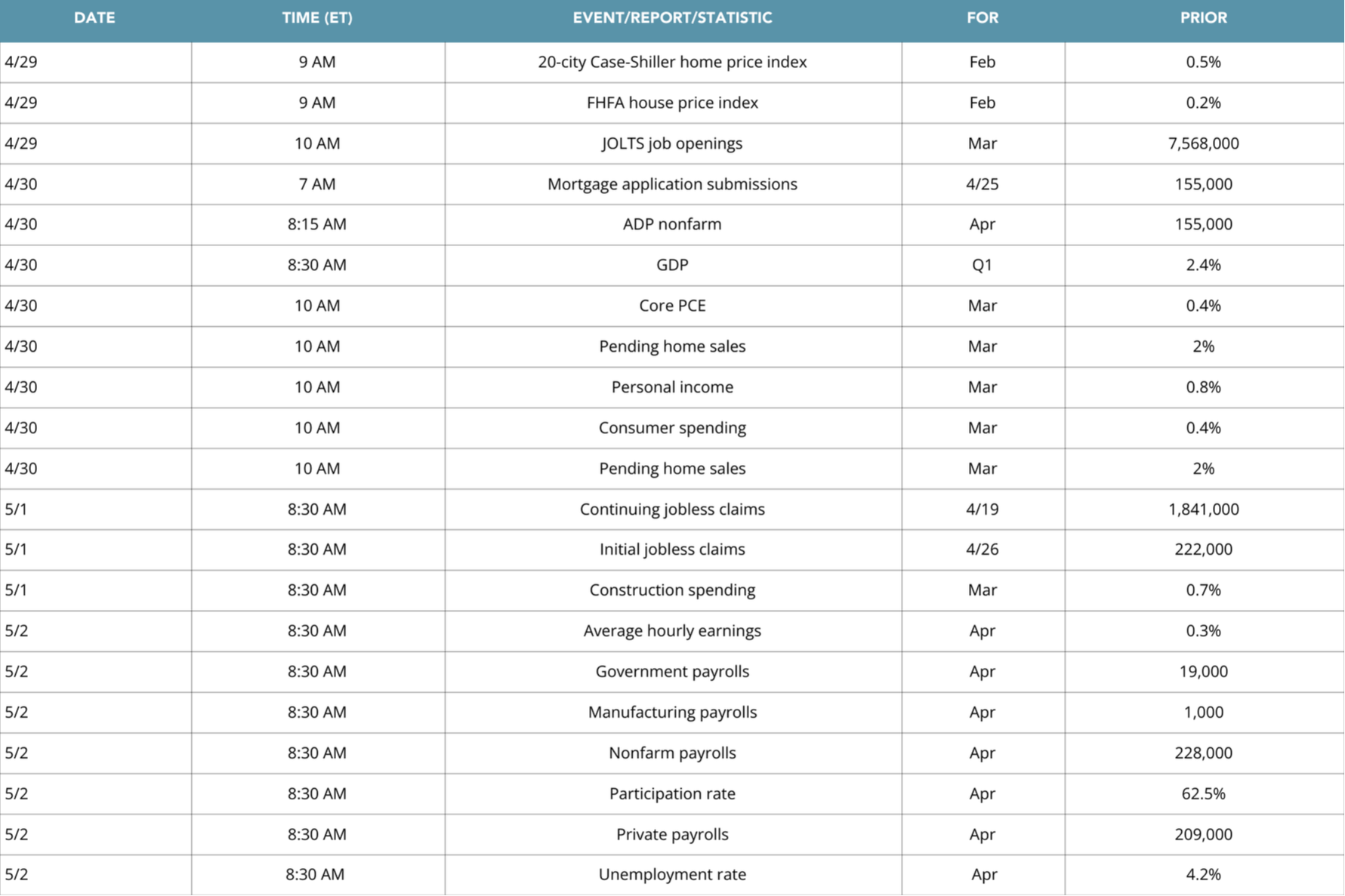

This week's important economic reports include:

|

|

|

|

|

|

WEEK OF JANUARY 9th, 2023

|

|

|

|

|

|

Sincerely,

|

Jennifer Bryant-Whitmire

NMLS# 832864, GA# 33335/Branch NMLS# 1518270

Sr. Loan Officer | CMG Home Loans

Mobile: (423) 595-5753

Apply Now: my.cmghomeloans.com/dr/c/08i6r

525 W. Main Street | Chattanooga, TN 37402 |

CMG Mortgage, Inc. dba CMG Home Loans dba CMG Financial, NMLS# 1820, is an equal housing lender, Georgia Residential Mortgage Licensee #15438.

![]()